do nonprofits pay taxes on interest income

For example if a nonprofit purchased 10000 worth of 10 percent bonds using 6000 cash and. An exempt organization that has 1000 or more gross.

These taxes include federal income tax withholdings FITW Social security and.

. Your recognition as a 501 c 3 organization exempts you from federal income tax. The nonprofit must recognize taxable income in the proportion that the property is financed. Do nonprofit organizations have to pay taxes.

Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types. Tax Exempt if All unrelated items eg snacks and drinks Minimum Suggested Donation items. Taxable if Income from any item given in exchange for a donation that costs the.

Both charities and nonprofit organizations do not have to pay income tax. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. This guide is for you if you represent an organization that is.

Federal Unemployment Taxes FUTA taxes are required from nonprofits but a 501 c 3 organization that is exempt from income taxes is exempt from FUTA. NPOs do not have to pay taxes but they may have to submit Form T1044 Non-Profit Organization. Qualifying nonprofits are exempt from paying federal income tax although they may still have to pay excise taxes income tax on unrelated business activities and.

An agricultural organization a board. But nonprofits still have to pay. Yes even tax-exempt nonprofit organizations must pay the usual payroll taxes for employees.

However this corporate status does not. Yes nonprofits must pay federal and state payroll taxes. While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes.

However here are some factors to consider when. Just because you have a tax-exempt status it does not mean that youre well tax. But determining what are an.

As long as a 501 c 3 corporation maintains its eligibility as a tax-exempt organization it will not have to pay tax on any profits. June 30 2021. They do not have to file a.

Even though an organization is recognized as tax exempt it still may be liable for tax on its unrelated business taxable income. Up to 25 cash back While nonprofits can usually earn unrelated business income UBI without jeopardizing their nonprofit status they have to pay corporate income taxes on it. Most nonprofits do not have to pay federal or state income taxes.

Do Nonprofits Pay Taxes. Did you know that sometimes nonprofits must pay income tax. A non-profit organization NPO as described in paragraph 149 1 l of the Income Tax Act.

Entities organized under Section 501 c.

Statement Of Financial Activities Nonprofit Accounting Basics

A Sample Chart Of Accounts For Nonprofit Organizations Altruic Advisors Chart Of Accounts Accounting Payroll Taxes

Donation Tax Receipt Template Business

Irs 501 C Subsection Codes For Tax Exempt Organizations Harbor Compliance Nonprofit Startup Coding Nonprofit Fundraising

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

Difference Between Charity Think Tank Business Administration

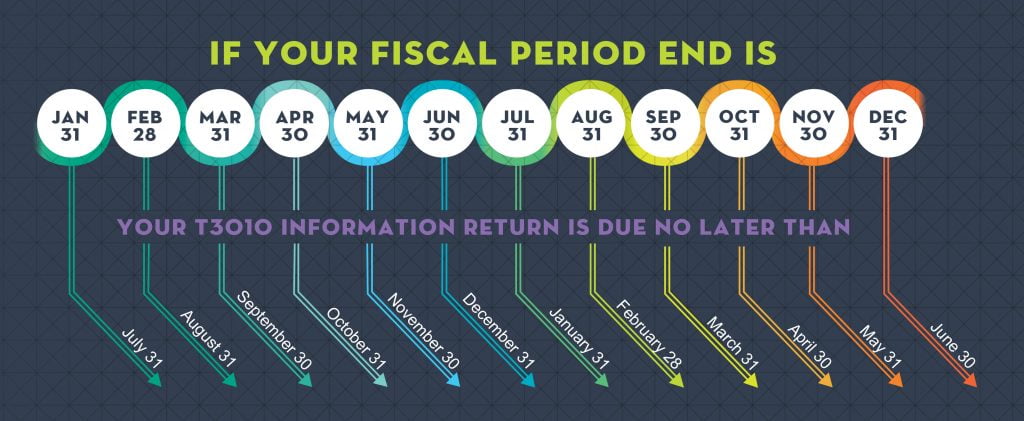

Canadian Tax Requirements For Nonprofits Charitable Organizations

Nonprofit Sample Documents Nonprofit Startup Non Profit Nonprofit Management

![]()

Canadian Tax Requirements For Nonprofits Charitable Organizations

40 Non Profit Budget Template Desalas Template Budget Template Budgeting Nonprofit Startup

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

Click To View The Full Size Infographic On Corporate Sponsorship Sponsorship Proposal Nonprofit Startup Fundraising Letter

Fiscal Sponsorship For Nonprofits Sponsorship Levels Nonprofit Startup Sponsorship

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)